Effectively communicating Bank Policies – how to best reach ordinary households

Since policymakers reduced interest rates to zero, there has been growing interest in better understanding and utilizing economic policies that operate through their effects on household expectations. In this context, policy communication has become a crucial instrument in central banks’ toolboxes. The unprecedented challenge: How to reach ordinary households, who do not understand and are not interested in policy statements? To tackle this question, the aim was to use an innovative methodology: Randomized control trials with information treatments for a large representative population of more than 5,000 participants. However, the feasibility of the research design was unclear ex ante. With the YIN Grant 2019, I was able to pretest the research design, cover initial start-up costs, and attract third-party funding.

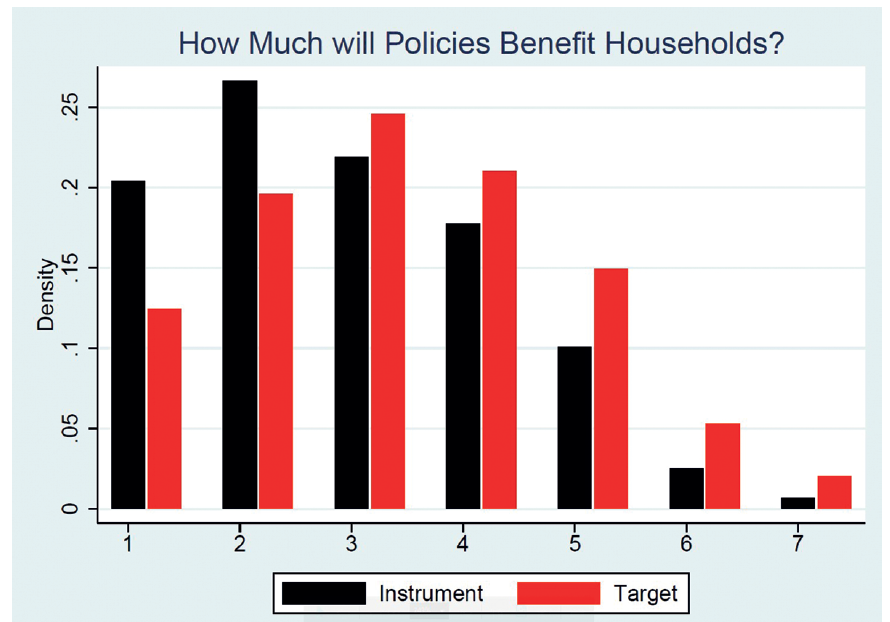

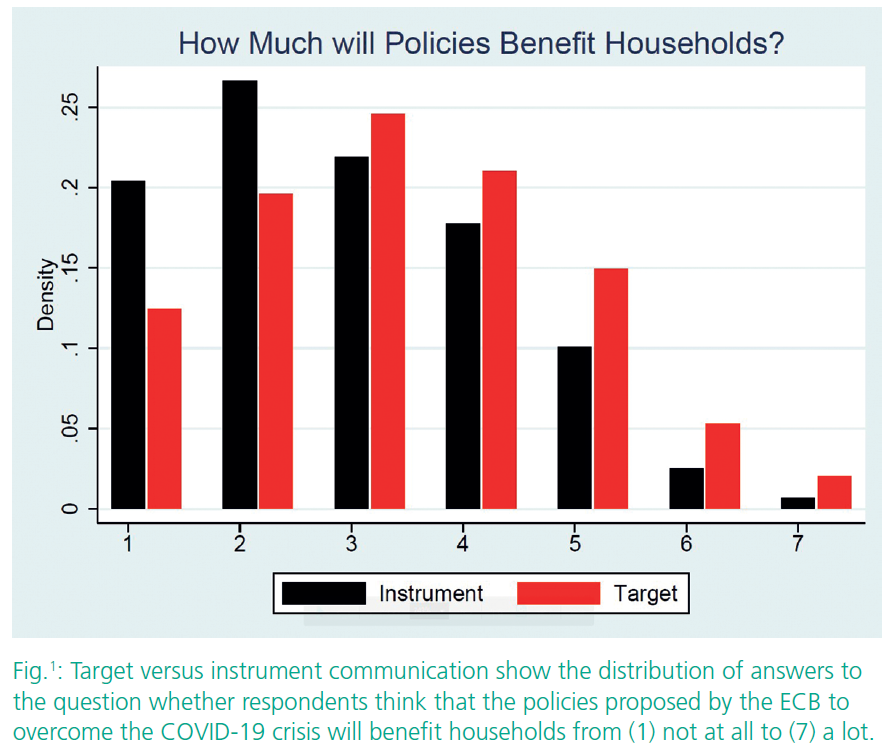

In the study, we randomly provided two groups of Finnish citizens with different forms of communication regarding the policies the ECB had implemented to counteract the negative shock of the COVID-19 crisis:

(1) Target communication, which emphasizes policy objectives rather than details of the programs: "The ECB will do whatever is necessary to minimize the financial damage to citizens caused by the corona crisis."

(2) Instrument communication, which emphasizes the policy instruments adopted: "The ECB launches a EUR 750 billion Pandemic Emergency Program."

We find that target communication is substantially more effective in increasing income expectations, and hence consumer confidence (see figure). This is especially true for the less sophisticated groups in populations with rather limited cognitive abilities. They are often least aware of economic news and less able to interpret the traditional (technical) central-bank communication. In addition, the group with the most pessimistic income expectations during the crisis reacts most positively to target communication. They benefit most from avoiding the vicious circle of lack of consumer confidence and drop in aggregate demand that prolong economic crises.

Overall, the results indicate that monetary policy communication can be a successful policy tool to manage ordinary households’ expectations. However, this effectiveness is highly enhanced when central banks emphasize the targets and aims of their policies rather than the specific policy measures with which they want to reach such aims.

Two years after receiving the YIN grant, the randomized control trial is completed (despite COVID-19), a working paper has been published, and the Fritz Thyssen Foundation has granted funding.